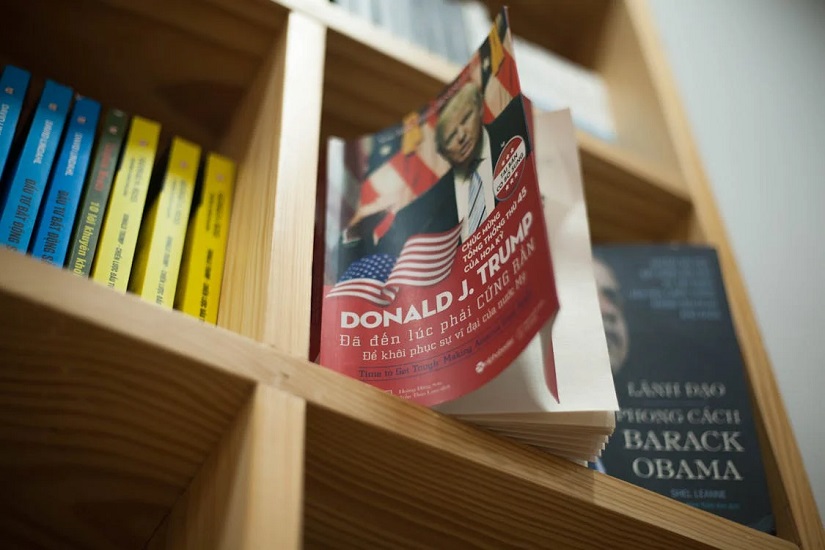

How President-Elect Trump’s Win Could Change Your Taxes

As the dust settles on the 2024 presidential election and former president Donald Trump reclaims the title of President-elect, Americans are contemplating the potential economic policies that will shape the next four years. One key concern on the minds of many voters is how their taxes may be influenced by this second Trump presidency.

Reflecting on Trump’s first administration and his campaign promises for his upcoming White House term offers insights into his approach to tax policies:

During his initial presidency, Trump introduced the Tax Cuts and Jobs Act (TCJA) in 2017. The TCJA implemented lower tax brackets, increased standard deductions, expanded child tax credits, and raised estate and gift tax exemptions, among other provisions. Notably, the tax breaks under the TCJA are scheduled to expire in 2025 unless Congress takes action. The termination of these benefits could potentially lead to increased taxes for over 60% of taxpayers. Trump has expressed a preference for extending all expiring TCJA tax breaks.

In addition to pursuing the extension of TCJA tax breaks – subject to Congressional approval, Trump has advocated for specific tax reforms. These proposed changes include the elimination of taxation on tips, cessation of taxing Social Security benefits for seniors, and the end of taxes on overtime pay. Trump has also suggested the radical shift of eliminating income taxes entirely in favor of imposing universal tariffs on all imported goods. However, the realization of these proposals hinges on Congressional support. Despite Republicans regaining control of the Senate, the House of Representatives’ political landscape remains ambiguous due to ongoing vote tabulations. Nonetheless, given his historical stance, Trump’s ultimate objective is likely to maintain lower tax rates.

As post-election preparations unfold, investors, taxpayers, and businesses must remain attentive to Trump’s tax agenda. The potential continuation of TCJA tax benefits and the prospect of further tax alterations emphasize the significance of understanding and adapting to the evolving tax environment under the anticipated Trump administration.